Need funds? Get an equity term loan with flexible terms

With our no-cost, confidential assessment, you’ll receive a personalised list of equity term loan options that match your unique financial situation, all without any effect on your credit score.

Our complimentary assessment will not affect your credit score

Need funds? Get an

equity term loan with flexible terms

With our no-cost, confidential assessment, you’ll receive a personalised list of equity term loan options that match your unique financial situation, all without any effect on your credit score.

Our complimentary assessment will not affect your credit score

Borrow up to

30 Years

Get a loan proposal

with no commitment

Find the lowest interest rates now!

Key features

of an equity term loan

-

Use Funds for Any Purpose

Unlike some specialized financing options, equity term loans come with minimal restrictions. Clients can use the funds for personal needs, business growth, debt consolidation, or other financial goals, providing ultimate flexibility. -

Lower Interest Rates Compared to Unsecured Loans

Secured against equity, these loans typically offer lower interest rates than unsecured personal or business loans. Clients benefit from cost-effective financing that minimizes overall borrowing costs. -

Longer Repayment Tenure

Equity term loans usually come with extended repayment periods, often ranging up to 30 years. This longer tenure allows borrowers to spread repayments over time, reducing the financial burden per month. -

Fixed Repayment Schedule

With predictable monthly repayments, equity term loans help clients manage cash flow effectively. Knowing exactly how much to pay each month reduces financial uncertainty and aids in long-term planning. -

Improve Financial Liquidity

By converting equity into cash, clients can improve their liquidity position without selling assets. This ensures that long-term investments remain intact while meeting immediate financial requirements.

-

Use Funds for Any Purpose

Unlike some specialized financing options, equity term loans come with minimal restrictions. Clients can use the funds for personal needs, business growth, debt consolidation, or other financial goals, providing ultimate flexibility. -

Lower Interest Rates Compared to Unsecured Loans

Secured against equity, these loans typically offer lower interest rates than unsecured personal or business loans. Clients benefit from cost-effective financing that minimizes overall borrowing costs. -

Longer Repayment Tenure

Equity term loans usually come with extended repayment periods, often ranging from 5 to 20 years. This longer tenure allows borrowers to spread repayments over time, reducing the financial burden per month. -

Fixed Repayment Schedule

With predictable monthly repayments, equity term loans help clients manage cash flow effectively. Knowing exactly how much to pay each month reduces financial uncertainty and aids in long-term planning. -

Improve Financial Liquidity

By converting equity into cash, clients can improve their liquidity position without selling assets. This ensures that long-term investments remain intact while meeting immediate financial requirements.

How does the

process work?

Fill in your details to kick off the loan process.

Your documents and eligibility are verified to match the right equity term loan options.

The lender checks your credit history and performs a risk assessment.

You’ll get a formal loan offer with all terms clearly outlined

Accept the offer, and the funds are released to your bank account.

What do i need to get started?

We accept applications from all individuals in Singapore. Properties that are eligible:

- Private Residential Properties

- Executive Condominiums

- HDB Shop Houses

- Commercial Properties

What you need to have to hand:

- Credit Bureau Report

Ready to apply?

The document requirements may change according to the loan size and type of company

What do i need

to get started?

We accept applications from all individuals in Singapore. Properties that are eligible:

- Private Residential Properties

- Executive Condominiums

- HDB Shop Houses

- Commercial Properties

What you need to have to hand:

- Credit Bureau Report

Ready to apply?

The document requirements may change according to the loan size and type of company

Loan calculator

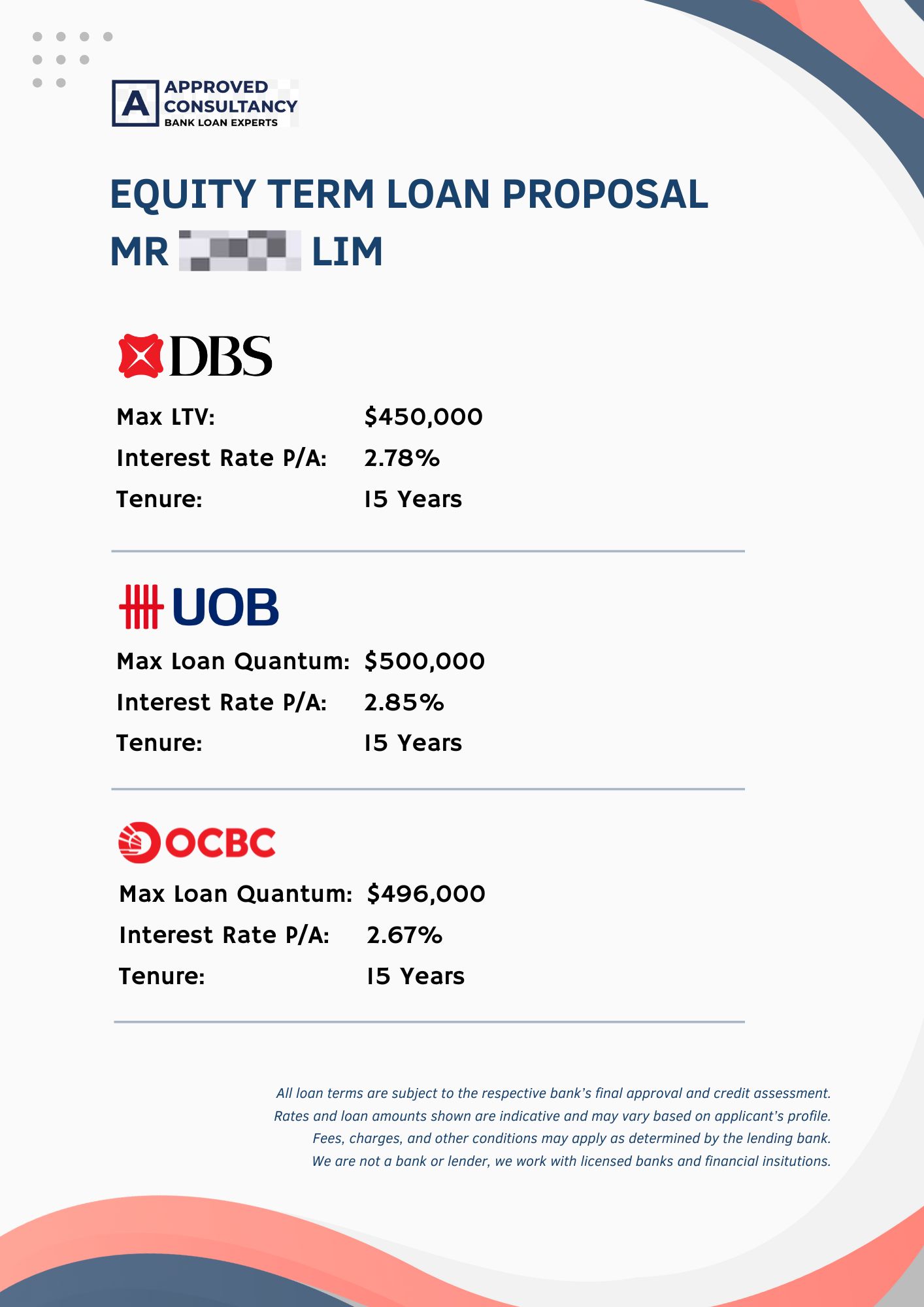

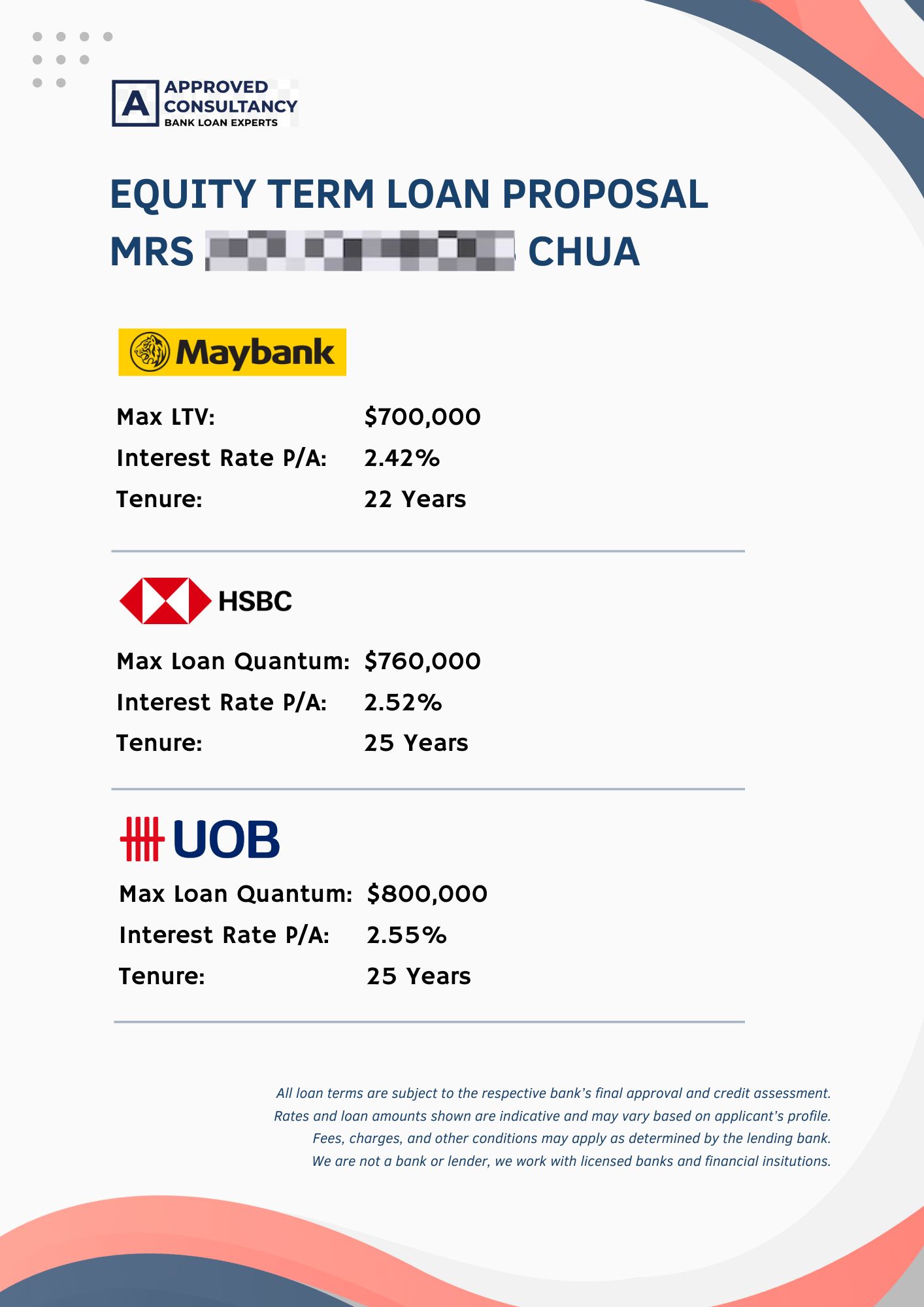

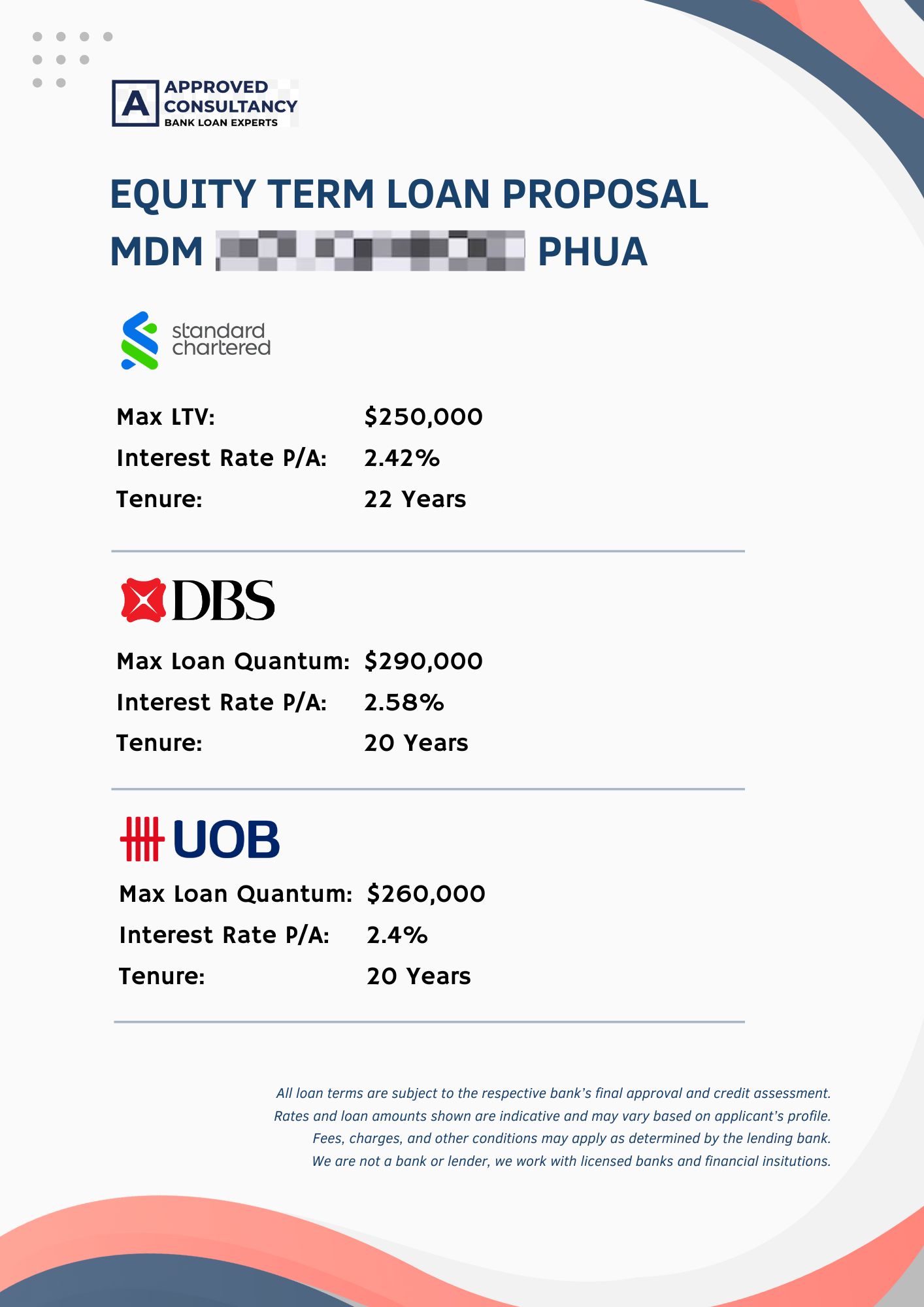

The typical interest rates for a equity term loan is around 2% to 3.5% per annum.

Below is our free loan calculator tool which you can use it to gauge your total costs.

Our business loan interest rates start at 1.5% a month.

We’ll only charge interest on your outstanding balance for the days you’re using your business loan.

Borrowing for over 12 months may incur an additional fee, typically it’s 5% when borrowing for 13 to 24 months and 6% for longer.

This loan calculator is only an example, your actual rate and repayment amount for your equity term loan will vary based on your circumstances.

Get the best equity term financing now!

How does it work?

- Submit the contact form with the relevant details

- Our team will contact you to start the assessment

- Receive your very own tailored loan proposal suited for your needs

Still need help?

- Find answers in our FAQ

- admin@approvedconsultancy.com

Loan Proposal Form

Frequently asked questions

Here are some questions our customers ask. Check our FAQs for anything we haven’t covered.

The loan amount is usually calculated as a percentage of the asset's equity. For property-backed loans, this can range from 50% to 85% of the property’s current market value minus any existing mortgages and CPF usage.

The final amount depends on the lender’s risk assessment.

Typically, individuals and businesses with substantial equity in their property or other qualifying assets can apply.

Lenders assess eligibility based on the value of the equity, creditworthiness, income, and repayment capacity.

Yes, additional fees may include:

Legal fees

Valuation fees

Processing or administrative fees

Prepayment penalties (if applicable)

Yes, businesses can leverage equity in commercial property, equipment, or other assets.

Funds can be used for expansion, cash flow management, or working capital needs.

Key risks include:

Loss of collateral if you default

Interest rate fluctuations (for variable rate loans)

Overborrowing leading to financial strain