Instantly compare

business term loans to save time & money

Our no-obligation assessment is credit score–friendly and provides you with a tailored range of business term loan options from leading banks and funding institutions in Singapore.

Our complimentary assessment will not affect your credit score

Instantly compare

business term loans to save time & money

Our no-obligation assessment is credit score–friendly and provides you with a tailored range of business term loan options from leading banks and funding institutions in Singapore.

Our complimentary assessment will not affect your credit score

No early

Repayment fees

Get a loan proposal

with no commitment

Find the lowest interest rates now!

Key features

of a business term loan

-

Access to Significant Capital for Large Projects

Business term loans are suitable for funding high-value initiatives that require substantial investment, such as purchasing property, machinery, or software systems, enabling companies to grow without compromising liquidity -

Competitive Interest Rates for Eligible Businesses

Banks and financial institutions in Singapore often offer business term financing with lower interest rates compared to revolving credit facilities. This can reduce financing costs for businesses with stable revenue and strong credit profiles. -

Predictable Funding for Expansion and Upgrades

Whether upgrading facilities, adopting new technology, or expanding into new markets, SME business term loan provides reliable financing that supports strategic decisions with minimal disruption to daily operations. -

Helps Optimize Cash Flow Management

By using a business term loan for long-term investments rather than day-to-day expenses, businesses can preserve working capital for operational needs while funding growth initiatives separately. -

Build Business Creditworthiness

Successfully managing a term loan improves your company’s credit profile, making it easier to secure future financing on better terms, including larger loans or favourable interest rates

-

Access to Significant Capital for Large Projects

Business term loans are suitable for funding high-value initiatives that require substantial investment, such as purchasing property, machinery, or software systems, enabling companies to grow without compromising liquidity -

Competitive Interest Rates for Eligible Businesses

Banks and financial institutions in Singapore often offer business term financing with lower interest rates compared to revolving credit facilities. This can reduce financing costs for businesses with stable revenue and strong credit profiles. -

Predictable Funding for Expansion and Upgrades

Whether upgrading facilities, adopting new technology, or expanding into new markets, SME business term loan provides reliable financing that supports strategic decisions with minimal disruption to daily operations. -

Helps Optimize Cash Flow Management

By using a business term loan for long-term investments rather than day-to-day expenses, businesses can preserve working capital for operational needs while funding growth initiatives separately. -

Build Business Creditworthiness

Successfully managing a term loan improves your company’s credit profile, making it easier to secure future financing on better terms, including larger loans or favourable interest rates.

How does the

process work?

Send in your enquiry so we can understand your financing needs.

Our team checks your financials and business profile to determine suitable loan options.

The bank verifies your documents, runs credit checks, and assesses your application.

Once approved, you’ll get a formal loan offer detailing the amount, rate, and terms.

Accept the offer and the lender disburses the funds straight to your business account.

What do i need to get started?

We accept applications from all businesses (no matter the age or industry), in fact all we ask is:

- Annual sales revenue above $200,000

- Minimum 30% local or PR shareholding

What you need to have to hand:

- Credit Bureau Report

- Latest 2 years of Notice Of Assesment (NOA)

- Latest 6 months of company bank statements

Ready to apply?

The document requirements may change according to the loan size and type of company

What do i need

to get started?

We accept applications from all businesses (no matter the age or industry), in fact all we ask is:

- Annual sales revenue above $200,000

- Minimum 30% local or PR shareholding

What you need to have to hand:

- Credit Bureau Report

- Latest 2 years Notice Of Assesment (NOA)

- Latest 6 months of company bank statements

Ready to apply?

The document requirements may change according to the loan size and type of company

Loan calculator

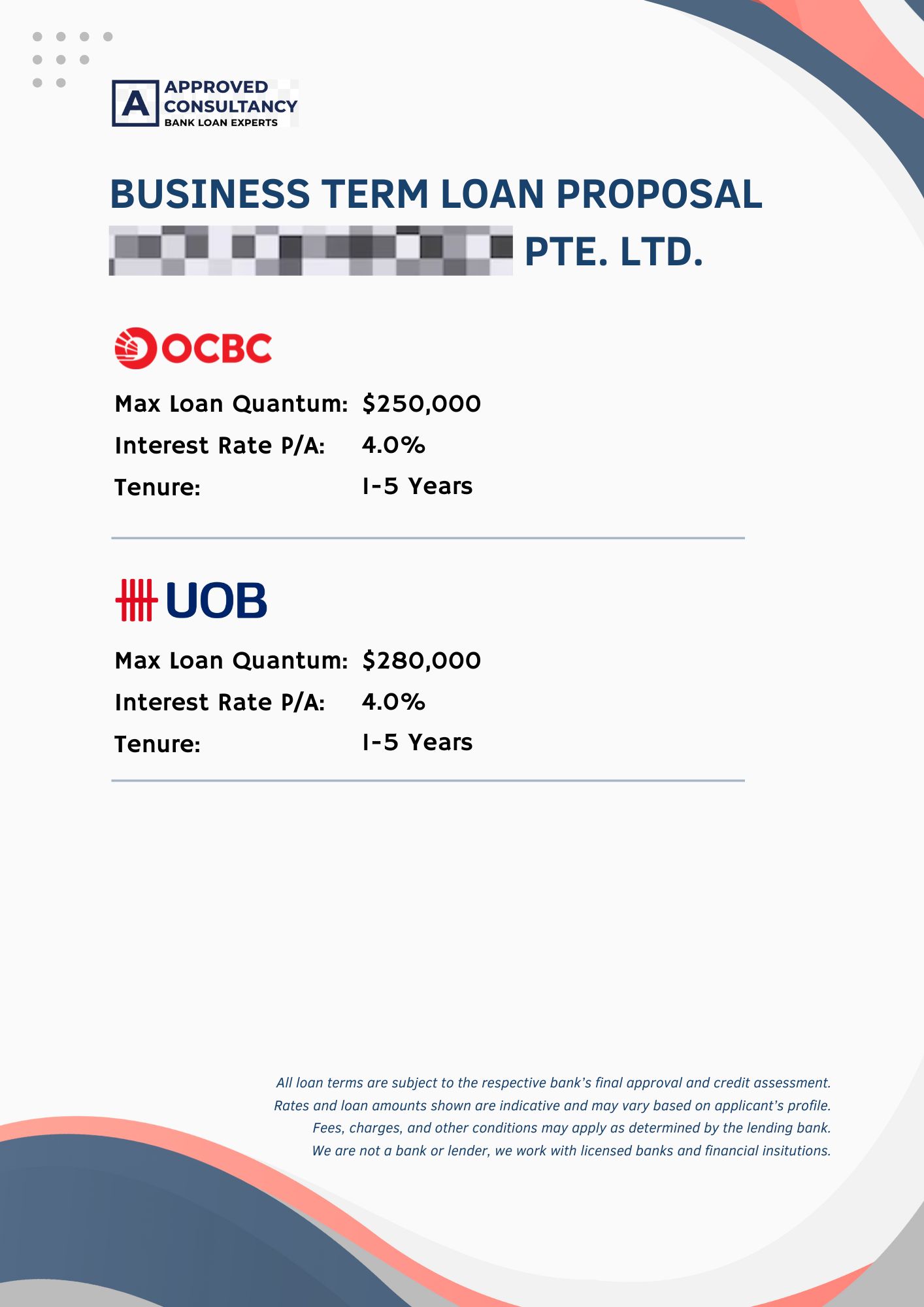

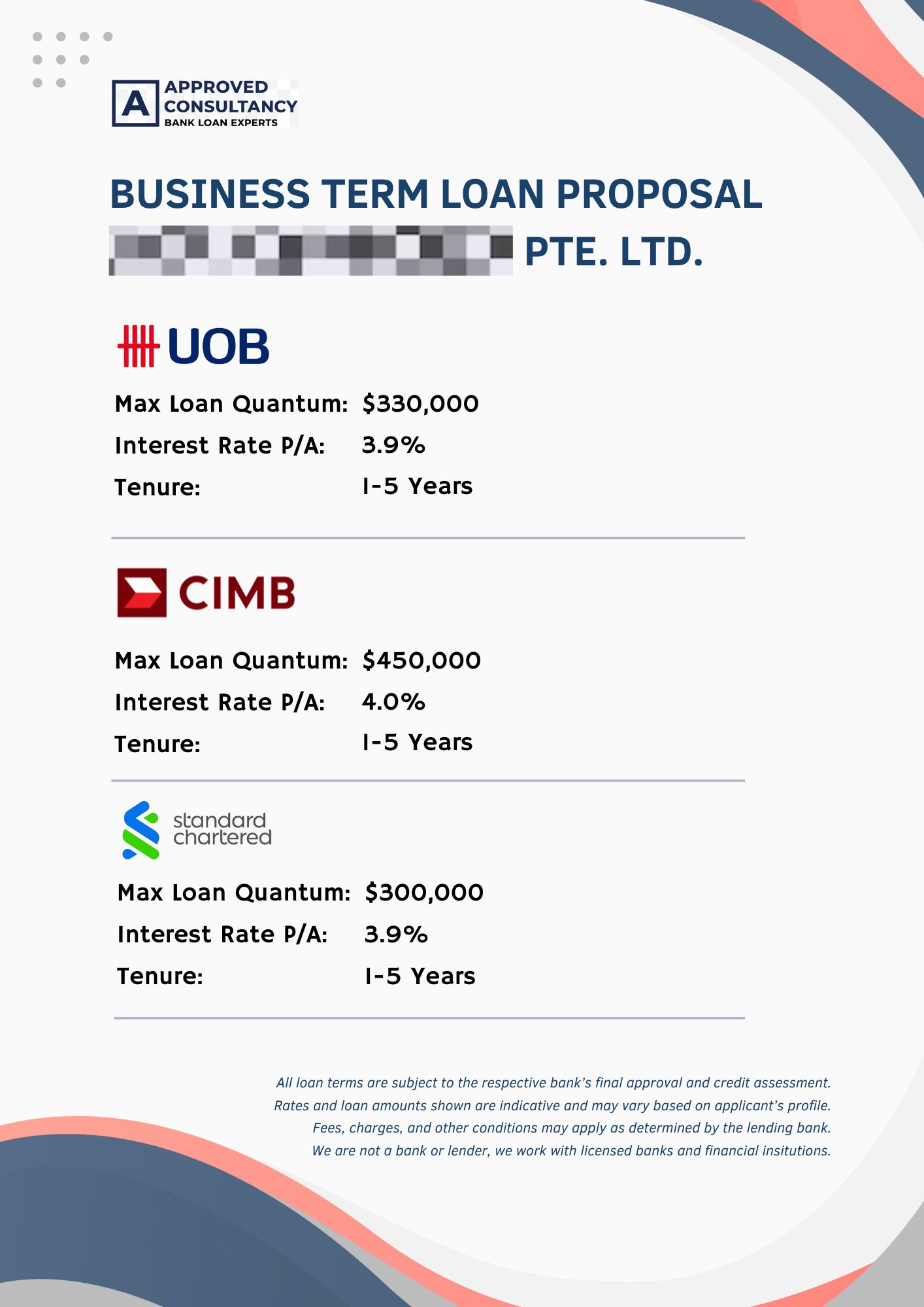

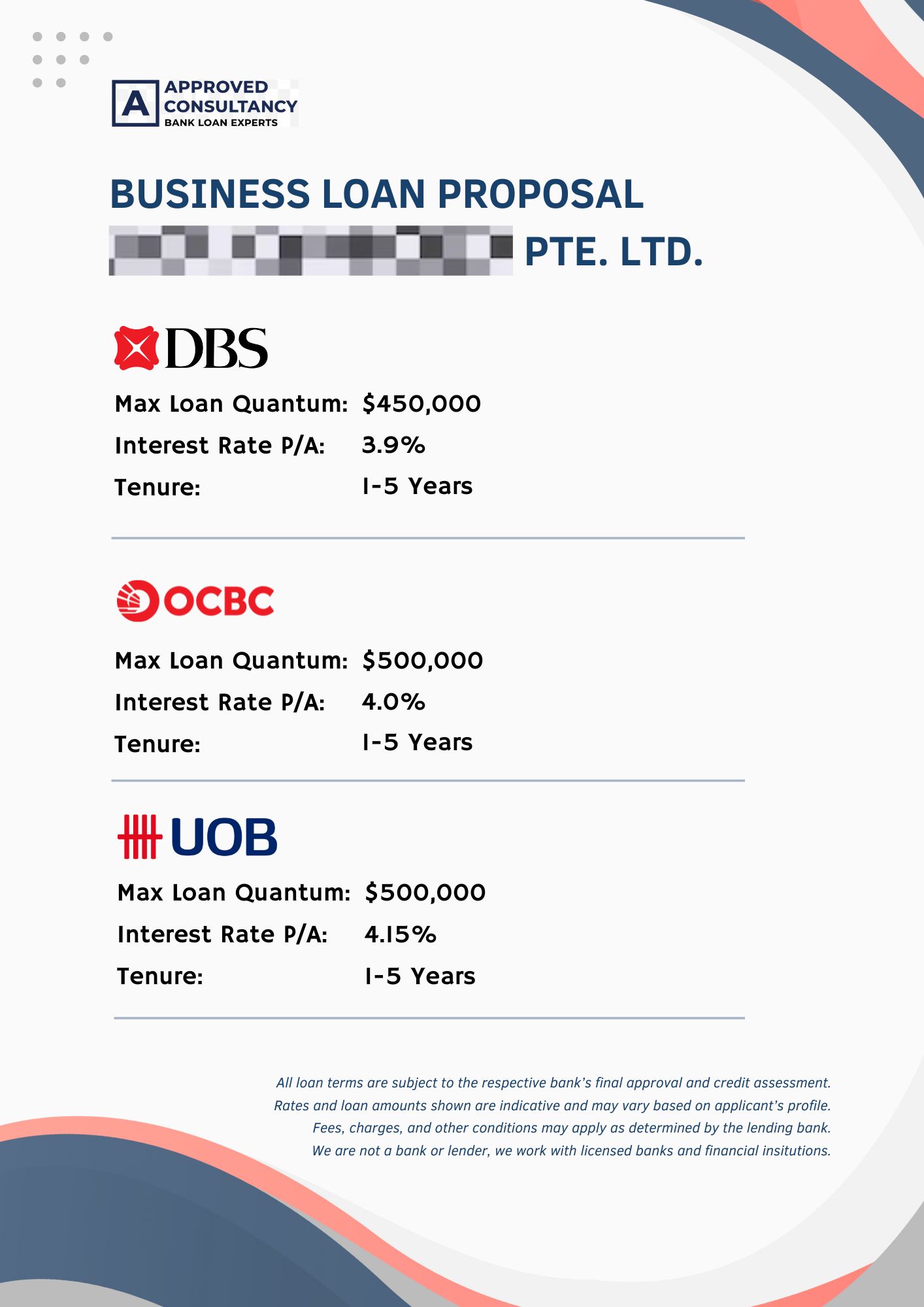

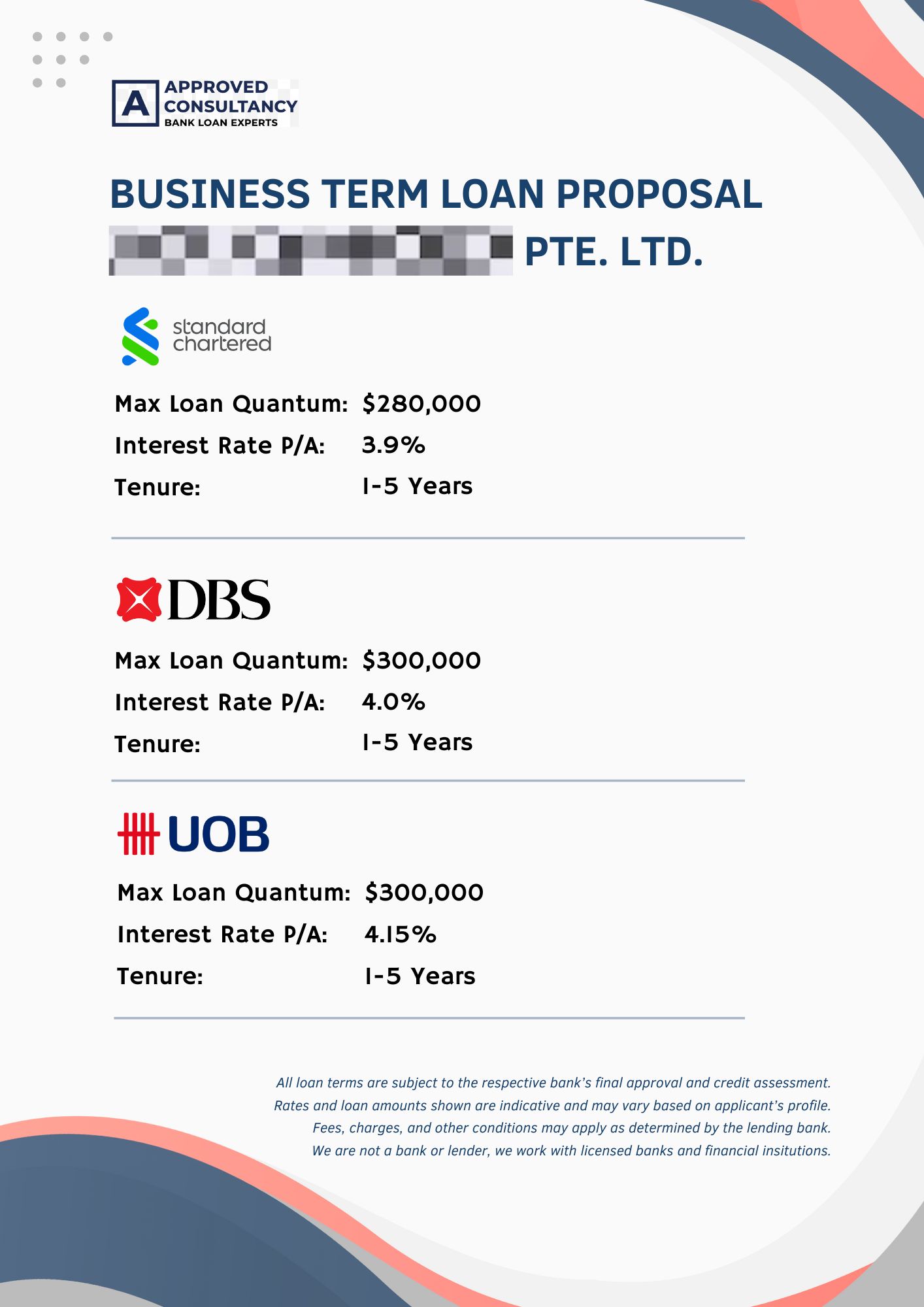

The typical interest rates for a business term loan is around 4% to 6% per annum.

Below is our free loan calculator tool which you can use it to gauge your total costs.

Our business loan interest rates start at 1.5% a month.

We’ll only charge interest on your outstanding balance for the days you’re using your business loan.

Borrowing for over 12 months may incur an additional fee, typically it’s 5% when borrowing for 13 to 24 months and 6% for longer.

This loan calculator is only an example, your actual rate and repayment amount for your business term loan will vary based on your circumstances.

Get the flexible business term loans based on your needs

How does it work?

- Submit the contact form with the relevant details

- Our team will contact you to start the assessment

- Receive your very own tailored loan proposal suited for your needs

Still need help?

- Find answers in our FAQ

- admin@approvedconsultancy.com

Loan Proposal Form

Frequently asked questions

Here are some questions our customers ask. Check our FAQs for anything we haven’t covered.

Purchase of machinery or equipment

Business expansion (new branches or outlets)

Technology or infrastructure upgrades

Large one-off operational needs

Business capital augmentation for longer-term projects

Many lenders allow early repayment, but some may charge an early repayment fee.

Terms vary and are disclosed in the loan agreement.

Startups may apply, but approval depends on revenue, cash flow, and projected business viability. Many traditional banks require at least 6-12 months of operations, while alternative lenders may consider younger businesses.

Yes. Business term loans are generally restricted to specific business purposes, such as:

Business expansion or renovations

Machinery or equipment purchase

Technology upgrades

Strategic projects

Using funds for unrelated personal purposes can breach loan agreements and trigger penalties.

Weak cash flow or negative revenue trends

Poor director or business credit history

Incomplete or inconsistent documentation

Excessive existing debt

Operating in high-risk or restricted industries