Compare

working capital loans across all lenders instantly

Our complimentary in-house assessment will not affect your credit score and you will receive a tailored list of options based on your eligibility for a working capital loan from different major banks or funding institutions.

Our complimentary assessment will not affect your credit score

Compare

working capital loans across all lenders instantly

Our complimentary in-house assessment will not affect your credit score and you will receive a tailored list of options based on your eligibility for a working capital loan from different major banks or funding institutions.

Our complimentary assessment will not affect your credit score

Borrow from

1 to 5 years

Get a loan proposal

with no commitment

Find the lowest interest rates now!

Key features

of a working capital loan

-

Access to Higher Loan Amounts Based on Business Profile

In Singapore, the maximum loan amount for a working capital loan varies by lender. Government-assisted schemes such as the Enterprise Financing Scheme – Working Capital Loan (EFS-WCL) offer up to S$500,000 per borrower. Banks and financial institutions assess your revenue, profitability, and credit standing to determine the final approved amount and interest rates—giving stronger businesses the potential to secure higher funding. -

Provides Steady Cash Flow for Daily Business Needs

A working capital loan helps businesses maintain healthy cash flow by covering essential operating expenses such as payroll, rent, utilities, and inventory. This ensures your company continues running smoothly even during slower revenue periods. -

Longer Repayment Periods for Better Cash Management

Most banks in Singapore offer working capital loans with repayment tenures between 1 to 5 years. These extended timelines make monthly instalments more manageable, giving SMEs the flexibility to stabilise their cash flow while growing the business. -

No Collateral Required for Eligible SMEs

One of the biggest advantages of a working capital loan is that it is typically unsecured. Businesses don’t need to pledge physical assets like property or equipment, making it easier and safer for SMEs to access timely financing when they need it. -

Helps Bridge Seasonal or Temporary Cash Flow Gaps

A working capital loan is particularly useful for businesses that experience seasonal fluctuations or delayed customer payments. The additional liquidity helps you stay on track with supplier payments, operational costs, and ongoing projects throughout the year.

-

Access to Higher Loan Amounts Based on Business Profile

In Singapore, the maximum loan amount for a working capital loan varies by lender. Government-assisted schemes such as the Enterprise Financing Scheme – Working Capital Loan (EFS-WCL) offer up to S$500,000 per borrower. Banks and financial institutions assess your revenue, profitability, and credit standing to determine the final approved amount and interest rates—giving stronger businesses the potential to secure higher funding. -

Provides Steady Cash Flow for Daily Business Needs

A working capital loan helps businesses maintain healthy cash flow by covering essential operating expenses such as payroll, rent, utilities, and inventory. This ensures your company continues running smoothly even during slower revenue periods. -

Longer Repayment Periods for Better Cash Management

Most banks in Singapore offer working capital loans with repayment tenures between 1 to 5 years. These extended timelines make monthly instalments more manageable, giving SMEs the flexibility to stabilise their cash flow while growing the business. -

No Collateral Required for Eligible SMEs

One of the biggest advantages of a working capital loan is that it is typically unsecured. Businesses don’t need to pledge physical assets like property or equipment, making it easier and safer for SMEs to access timely financing when they need it. -

Helps Bridge Seasonal or Temporary Cash Flow Gaps

A working capital loan is particularly useful for businesses that experience seasonal fluctuations or delayed customer payments. The additional liquidity helps you stay on track with supplier payments, operational costs, and ongoing projects throughout the year.

How is the

process like?

Share your business details for an initial assessment.

Your financials and business profile are reviewed to determine loan options.

The lender performs credit checks, document verification, and risk assessment.

Upon approval, you’ll receive the loan offer with the approved amount, tenure, and interest rate.

Once accepted, funds are released to your business account.

What are the requirements to start?

We accept applications from all businesses (no matter the age or industry), in fact all we ask is:

- Annual sales revenue below $100M

- Minimum 30% local or PR shareholding

What you need to have to hand:

- Credit Bureau Report

- 2024 & 2025 Notice Of Assesment (NOA)

- Latest 6 months of company bank statements

Ready to apply?

The document requirements may change according to the loan size and type of company

What are the requirements

to get started?

We accept applications from all businesses (no matter the age or industry), in fact all we ask is:

- Annual sales revenue below $100M

- Minimum 30% local or PR shareholding

What you need to have to hand:

- Credit Bureau Report

- Latest 2 years Notice Of Assesment (NOA)

- Latest 6 months of company bank statements

Ready to apply?

The document requirements may change according to the loan size and type of company

Loan calculator

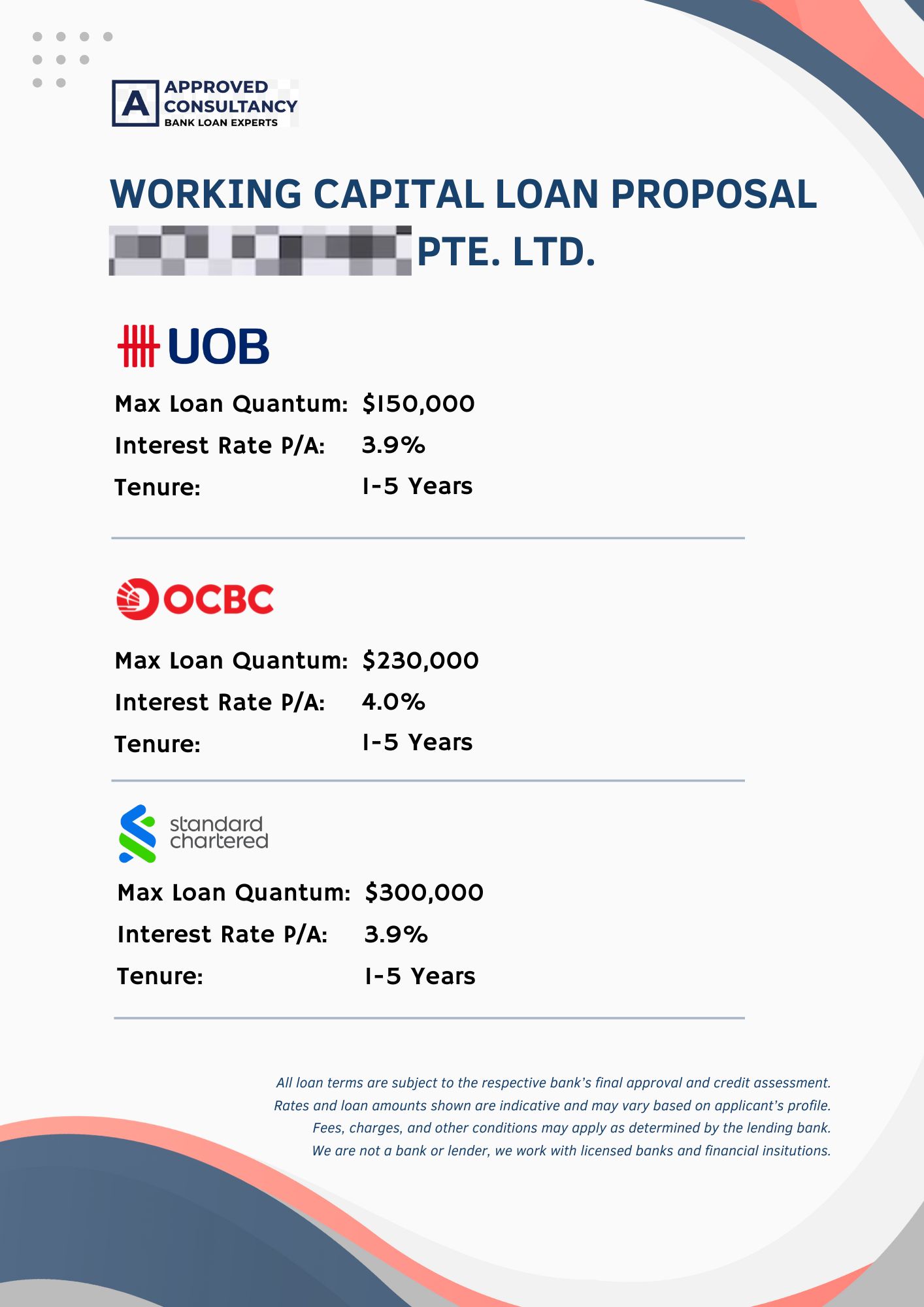

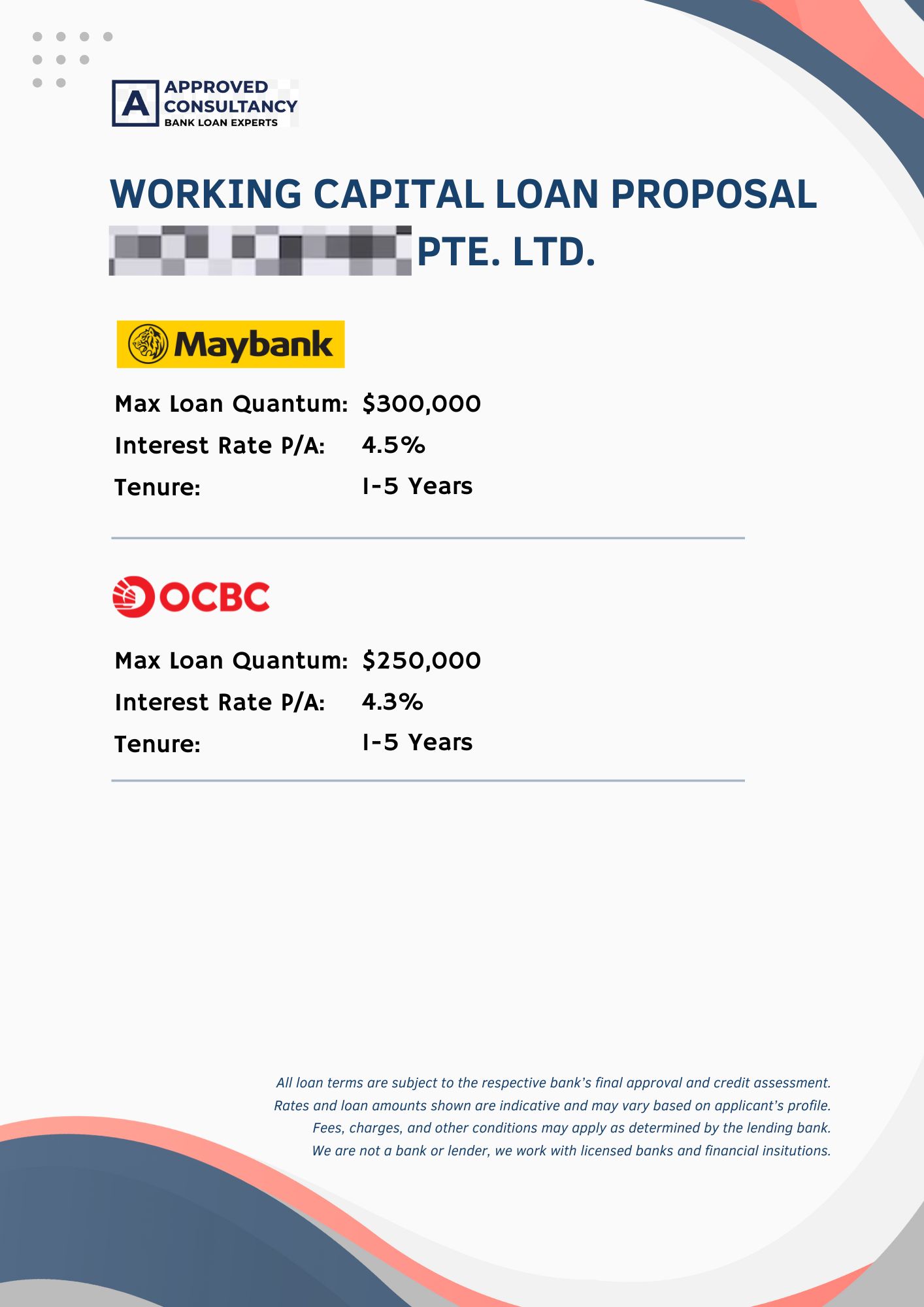

The typical interest rates for a working capital loan is around 4% to 4.5% per annum.

Below is our free loan calculator tool which you can use it to gauge your total costs.

Our business loan interest rates start at 1.5% a month.

We’ll only charge interest on your outstanding balance for the days you’re using your business loan.

Borrowing for over 12 months may incur an additional fee, typically it’s 5% when borrowing for 13 to 24 months and 6% for longer.

This loan calculator is only an example, your actual rate and repayment amount for your business loan will vary based on your circumstances.

Get the best working capital loan on your terms

How does it work?

- Submit the contact form with the relevant details

- Our team will contact you to start the assessment

- Receive your very own tailored loan proposal suited for your needs

Still need help?

- Find answers in our FAQ

- admin@approvedconsultancy.com

Loan Proposal Form

Frequently asked questions

Here are some questions our customers ask. Check our FAQs for anything we haven’t covered.

Most banks prefer SMEs that have been operating for at least 1 year, but this varies.

Some lenders accept younger companies if bank statements show stable cash flow, while others apply stricter criteria for new businesses.

There is no fixed operating age requirement written into the EFS-WCL guidelines.

Yes — in nearly all unsecured working capital loans, a personal guarantee from one or more directors is standard.

This helps lenders mitigate the higher risk of unsecured lending.

Once your loan is approved and you sign the Letter of Offer, funds are typically disbursed within 5 working days, depending on the lender’s internal processing speed and KYC checks.

No. GST registration is not a requirement for working capital loans.

Lenders may request GST filings only if your company is registered, as these provide another source of revenue verification.

Yes. SMEs with ongoing loans can still qualify as long as:

They have a manageable debt-to-income ratio

They can demonstrate repayment ability

Lenders look at total financial commitments, not just your loan count.